Daily Crypto Market Brief - Halloween Options Expiry: Crypto Slips, Policy Tailwinds

Market Overview (24-Hour Snapshot)

Prices & Market Cap

Bitcoin trades at $109,287 (—0.39% in 24h), testing support above $106,000 after a mid-week recovery from lows near $106,411 on October 30. Global market cap sits at $3.69–3.76 trillion, down approximately 0.85–1.5% in 24 hours following brief liquidation waves. Total market cap is down ~6.7% for October—marking the first “red Uptober” in seven years.1234

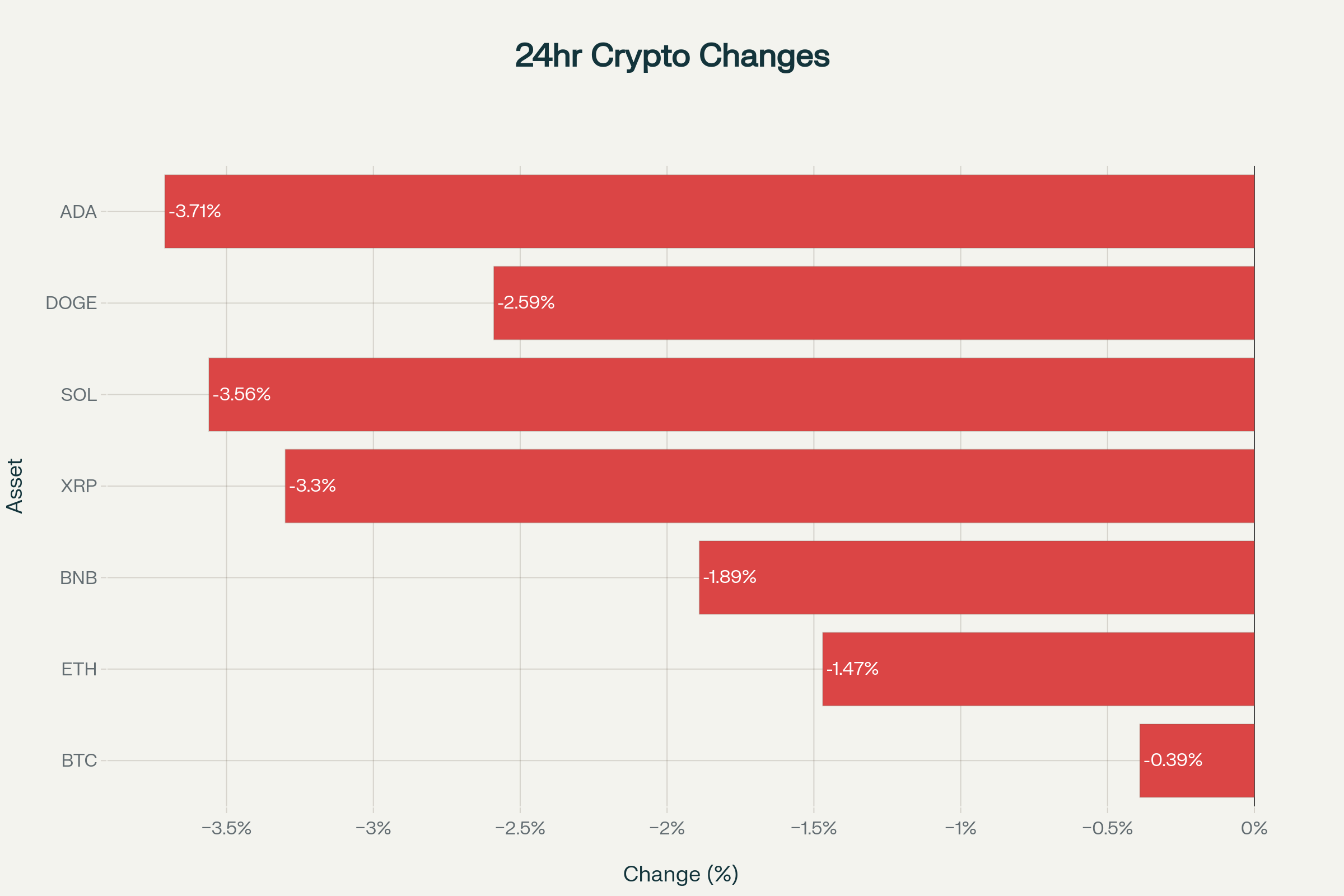

24-Hour Cryptocurrency Price Performance (October 31, 2025)

Top Movers

Ethereum at $3,854–$3,862 (—0.8% to —1.47% in 24h) remains under pressure below $4,000; technical indicators suggest further downside risk to $3,750–$3,840 if key support breaks. Among top 10 alts by market cap, SOL (—3.56%), XRP (—3.30%), and ADA (—3.71%) underperformed; FLM (+27%), SOLV (+12%), and SYN (+7%) bucked the trend.25

AVAX continues steep October losses, off —39.05% from month-start as it fell below $21.50 support. Major altcoin laggards include PEPE (—29.55%), ICP (—30.72%), ARB (—30.05%), and WLD (—35.74%).4

Derivatives & Liquidations

$16–17 billion in Bitcoin and Ethereum options expire today (October 31) at 08:00 UTC on Deribit—the largest monthly derivatives event of the year. Max pain is $114,000 for BTC and $4,100 for ETH; put-to-call ratios stand at 0.70 (mild bullish bias) for both. Open interest has fallen 1.31% to $159B, signaling reduced leverage and trader exhaustion. Over $890M in longs liquidated in past 24 hours, with Bitcoin accounting for $310M and Ethereum $195M.13678

Funding & Stablecoins

Average funding rate sits at —0.0018%, reflecting negative sentiment despite price stabilization. Stablecoin supply reached $300B in Q3 2025—an ATH—with USDT at 59% market share and USDC at 24–25%. USDT and USDC trading volume hit $18.7 trillion YTD, with Q3 reaching $9.6 trillion (+40% QoQ). Tether is preparing USAT (US-compliant stablecoin) launch; Circle’s USDC blockchain and major fintech stablecoin rollouts (Robinhood, Revolut) are underway.6910

Top Headlines (What & Why It Matters)

1. $16B Options Expiry Looms; Max Pain Could Drive Price Action (8:00 UTC Today)

Over $16 billion in BTC and ETH options settle today: 124,171 BTC contracts ($13.59B) and 646,902 ETH contracts ($2.49B). Max pain levels at $114,000 (BTC) and $4,100 (ETH) may attract market-maker hedging activity. Out-of-the-money positioning at 82.5% suggests speculative bets rather than hedges, amplifying volatility near expiry.178

Risk Level: {High} — Timing coincides with potential macro catalysts and Fed commentary uncertainty.

2. Canary Funds’ XRP ETF on Track for November 13 Auto-Effective Launch

Canary Funds removed the SEC “delaying amendment” from its XRP spot ETF S-1 filing, invoking Section 8(a) of the Securities Act of 1933 for automatic effectiveness after a 20-day waiting period. If the SEC does not object, launch is targeted for November 13, 2025 on Nasdaq (with Gemini and BitGo as custodians). Polymarket odds now show >99% probability of SEC approval by year-end 2025. This would make XRP the first spot ETF to launch post-Solana/Litecoin/Hedera wave.111213

Risk Level: {Low to Medium} — SEC intervention possible but politically unlikely under current administration.

3. Michael Selig Nominated as CFTC Chair; Crypto-Friendly Regulator Signals “Rules, Not Enforcement”

On October 25, President Trump formally nominated Michael Selig to lead the CFTC. Selig is Chief Counsel to the SEC Crypto Task Force, a former law clerk at CFTC under “Crypto Daddy” Christopher Giancarlo, and long-time crypto advocate. White House Crypto Czar David Sacks endorsed him as “deeply knowledgeable” and “passionate about modernizing our regulatory approach.” Confirmation hearing date TBD; if confirmed, Selig is expected to pivot CFTC focus from case-by-case enforcement to clear activity-based guidance. Senate Agriculture Committee confirmed Mike Selig nomination on October 27, 2025.1415

Risk Level: {Low} — Bipartisan support likely; represents favorable regulatory shift for on-chain activity and DeFi.

4. Senate Agriculture Committee Finalizes Updated Crypto Market Structure Bill; Release Expected This Week

The U.S. Senate Agriculture Committee is set to release an updated draft of the Crypto Market Structure Bill within days. Key updates exempt staking, airdrops, and DePIN projects from securities classification and shield DeFi developers from undue liability. The bill formalizes CFTC oversight of digital commodities and spot markets, while the SEC retains control over securities. A formal classification system (digital commodities, investment contract assets, permitted payment stablecoins) aims to end regulatory ambiguity. Lawmakers target House–Senate reconciliation and presidential signature before year-end.161718

Risk Level: {Medium} — Industry consensus; final passage faces timing and political challenges mid-federal shutdown.

5. Bitcoin Miners Raise $11B in Convertible Debt; HPC Expansion Accelerates amid AI Pivot

Mining companies are aggressively raising capital for AI-driven high-performance computing infrastructure. Miner profitability remained healthy in Q2 2025 despite rising hashrates: gross profits ~$2.1B with margins near 53%, per JPMorgan. However, on-chain data shows BTC.com transferred 186,000 BTC (~$19.9B) to Binance in October, signaling miner distress selling near local lows to cover operational costs. Miner revenue per day sat at $55.77M on October 13 but remains under margin pressure as difficulty adjusts upward.61920

Risk Level: {Medium} — Miner selling can inject sustained supply pressure; AI capex diverts from core mining optimization.

6. Crypto Funding Surges Past $19B YTD; Polymarket Raises $2B from ICE

In October alone, 27 crypto firms raised over $2.5B, bringing 2025 total to $19B (vs. $10B in 2024). Polymarket led with a $2B strategic investment from Intercontinental Exchange (ICE, parent of NYSE), valuing it at ~$9B. Other major rounds: Bermuda life insurance (Bitcoin savings) $82M Series B; Amdax (Bitcoin treasury firm) $35M. Industry projections now target $25B+ by year-end 2025. M&A surged 30-fold in 2025 vs. 2024, with deals like FalconX–21Shares merger signaling mainstream finance integration.21222324

Risk Level: {Low} — Validates institutional conviction and diversifying capital deployment beyond spot trading.

7. JPMorgan Completes Tokenized Private Equity Fund Pilot; Announces 2026 Launch of Tokenization Platform

JPMorgan Chase completed pilot tokenization of a private equity fund on its proprietary blockchain (JPM Coin). The bank announced plans to launch its “Alternative Investment Fund Tokenization Platform” in 2026, offering institutional clients on-chain issuance and trading of private equity, credit, and non-public market assets. This milestone signals major traditional finance interest in blockchain settlement infrastructure and real-world asset (RWA) tokenization.25

Risk Level: {Low} — Validates RWA narrative; institutional adoption remains gradual.

8. Senate Passes Resolution to End Trump Global Tariff Policy; Crypto Markets Stabilize

The U.S. Senate passed (51–47) a resolution terminating Trump’s global tariff emergency declaration, partly reducing geopolitical trade friction that triggered the October 11 $19B liquidation cascade. Additional resolutions on Canada and Brazil tariffs now move to the House. While crypto does not directly trade tariffs, reduced macro uncertainty supports sentiment recovery.25

Risk Level: {Low to Medium} — Positive for broader sentiment; House override uncertain.

Exchange Announcements

Coinbase

- Maintenance Window (Oct 25, 2025): Coinbase went offline on October 25, 2025 at ~07:00 AM PT for scheduled systems upgrade; duration was approximately 2–4 hours.26

- New Listings: BNB and Keeta (KTA) newly listed; Futures trading for SUI now live.26

- Delistings: WELL-PERP and FAI-PERP removed from futures trading.26

- Blue Carpet Initiative (Oct 14): Coinbase launched “The Blue Carpet,” a consolidated, fee-free asset listing experience with direct listings team access, customizable asset pages, and referral discounts. BNB added to roadmap 33 minutes later—a significant nod to Binance’s flagship token. (Disputed: exact BNB listing timeline remains pending market-making and compliance verification.)2726

Binance

- Momentum (MMT) Prime Sale: Launched October 31, 2025. Max subscription 7 BNB per user (~$0.1 USD per MMT token); 15M total MMT allocation; $1.5M fundraise. TGE airdrop to Binance Alpha accounts same day.25

Deribit

- $16B Options Expiry: October 31 at 08:00 UTC; 124,171 BTC contracts and 646,902 ETH contracts settle. Max pain $114,000 (BTC) and $4,100 (ETH).17

Crypto Fear & Greed Index: Fell to 29–31 (“Fear” territory), reflecting heightened investor unease after liquidation cascades and weak rally follow-through.36

Government / Law & Regulation

U.S. – SEC & CFTC

- CFTC Chair Nomination (Oct 25–27): Michael Selig nominated October 25; Senate Agriculture Committee confirmed receipt October 27. Selig is expected to shift CFTC toward pro-innovation “rules” stance.1415

- Crypto Market Structure Bill (Updated Oct 30): Senate Agriculture Committee finalized draft exempting staking, airdrops, and DePIN from securities classification. Expected release within days. Establishes CFTC–SEC jurisdiction split and protects DeFi developers from liability.1617

- President’s Working Group on Digital Asset Markets (Oct): CFTC issued Request for Comment on PWG digital asset recommendations; deadline late November. Signals intent to reshape commodity vs. securities framework.14

- Federal Reserve Crypto Guidance Rescinded (April 2025; note for context): Fed, OCC, and FDIC withdrew prior restrictive guidance on bank crypto activities effective immediately. Banks no longer require supervisory nonobjection to engage in permissible crypto/stablecoin activities.282930

EU – MiCA Implementation

Taiwan (FSC) – No material updates in 48h window.

Singapore (MAS), Hong Kong (SFC/HKMA), Japan (FSA) – No material updates in 48h window.

Research & Technical Reports

a16z Crypto State of Crypto 2025 Report (Oct 22)

Report highlights institutional futures long bias at record levels, ETF absorption of significant Bitcoin supply, and APAC retail participation driving Solana activity. Key finding: Ethereum lags Bitcoin and Solana in retail adoption; retail inflows reshaping market structure toward higher volatility and speculative assets.31

IMF Crypto Assets Monitor Q3 2025 (Oct 9)

- Total stablecoin market cap reached $300B (up 14% QoQ). USDT trading volume surged to 82.5% of centralized exchange volume; USDC commands 63% of on-chain transfer volume (bot-driven at 83%). USDT now 66% backed by US Treasuries (vs. 24% in June 2021); non-compliant assets (crypto, metals) comprise 18.5% of USDT backing.10

- USDT and USDC trading volume hit $18.7 trillion YTD, with Q3 at $9.6 trillion (+40% QoQ).10

Glassnode + Gemini 2025 Market Trends Report (June, with Oct updates)

Institutional futures open interest surged: BTC +216% YoY to $50.9B; ETH +196% to $19.8B. Solana futures up 292%. Regional divergence: APAC leads retail; US remains ETF-dominated. Retail inflows reshaped market structure toward high-volatility speculation, with Solana surpassing Ethereum in active addresses.31

Messenger: October “Cursed Month” Analysis (Oct 30)

October 2025 decline (—6.7% total market cap) driven by: (1) Long-term holder profit-taking ($2–3B daily realized selling, peaking at $648M/day by 6–12m cohort); (2) US institutional demand collapse post-Sept rally (ETF inflows <1,000 BTC/day vs. avg. 2,500 BTC/day); (3) $19B single-day liquidation Oct 11 (Trump tariff shock); (4) Crypto security breaches ($2.47B in Q2 losses per CertiK); (5) On-chain metrics weakness (OBV near April lows).3233

Research Highlight: October 2025 Liquidation Cascade (Oct 11)

$19.1B in leveraged positions liquidated in 24 hours—the largest single-day event in crypto history. Bitcoin dropped 18% ($126K ATH → $104,782); Ethereum fell 20% below $4K; altcoins dropped 60–80%. $7B vanished in first hour; $65B in open interest collapsed. Funding rates had surged dangerously beforehand, entrapping over-leveraged longs.32

Security Incidents

Abracadabra DeFi Exploit (Oct 6)

Attackers exploited smart contract vulnerability in the ‘cook’ function, stealing $18M in MIM stablecoin by bypassing solvency checks. Funds were laundered through Tornado Cash. (Note: Earlier $13M flash loan attack on same protocol, March 5.)32

Phishing & AI-Driven Attacks Spike

AI-driven phishing surged 1,000% YoY; fraudulent Coinbase impersonation calls resulted in $100M+ in losses. Social engineering scams now account for 40.8% of crypto security incidents (per WhiteBIT, 2025), with impersonation and fake investment offers dominating. Technical wallet hacks (phishing, malware) comprise 33.7% of incidents. Telegram messaging platforms targeted in “scrolling scams” (10%+ of scam volume).3432

Lazarus Group North Korea AI Reconnaissance

Lazarus Group deployed AI to scan codebases and replicate exploits across blockchains in minutes, escalating breach frequency. The group has stolen $2B in 2025 alone (per earlier reports), including Bybit’s $1.5B theft (Feb). CertiK Q2 report recorded 344 separate incidents totaling $2.47B in losses; wallet compromises and infrastructure exploits averaged $30M each (2x 2024 losses).32

Risk Assessment: {Medium to High} — Exploits remain prevalent; real-time recovery infrastructure lag cited as key defense gap. Only ~5% of stolen assets recovered historically.35

Social & Sentiment

Official Channels & Verified Accounts

- Binance (@binance): Promoted MMT Prime Sale launch Oct 31; Wallet TGE airdrop messaging consistent.25

- Coinbase Markets (@CoinbaseMarkets): Announced Blue Carpet initiative and BNB roadmap inclusion (Oct 14–15).27

- Pavel Durov / Telegram (@durov): Announced Cocoon (decentralized AI inference network on TON) launching November 2025. Telegram will be first client; developers pay TON tokens for GPU power; GPU owners earn TON tokens. Durov emphasized billion-user activation of private AI on blockchain.3637

Crypto Community Sentiment

- Analyst @theunipcs (“Bonk Guy”): Posted bullish recovery narrative post-$107K test, arguing “price today does not matter for long-term; BTC to new ATHs this quarter.” (Note: Speculative, not backed by on-chain data; markets remain range-bound near $109K.)6

- Greeks.live analysts described market as “fragile bidless” post-liquidations; emphasized max pain levels and key support/resistance zones but flagged “unclear future direction absent new catalysts.”8

What to Watch (Next 24–72 Hours)

1. Deribit $16B Options Expiry (Today, Oct 31, 08:00 UTC) Max pain levels at $114K (BTC) and $4.1K (ETH) could drive tactical price moves. Monitor spot–futures basis and ETF flows for confirmation of breakout vs. consolidation.178

2. US Core PCE Price Index (Likely This Week) Federal Reserve’s preferred inflation measure due Friday or early next week. Hot reading could strengthen USD and pressure risk assets; markets pricing in hawkish surprise risk.6

3. Senate Crypto Market Structure Bill Release Finalized draft expected this week or next. Passage timeline and House reconciliation critical for industry sentiment (targets year-end 2025).161718

4. Telegram Cocoon AI Network Beta Launch (November) First institutional TON use case beyond Telegram messaging. GPU infrastructure onboarding and initial tokenomics testing will signal feasibility of decentralized compute-for-hire model.3637

5. XRP Spot ETF Auto-Effectiveness (Nov 13, 2025, If No SEC Objection) Canary Funds ETF auto-effective if SEC does not object within 20-day window. Institutional flows and price impact to XRP and broader spot ETF landscape to monitor.1213

Executive Summary & Confidence Statement

October 31, 2025 marks a critical inflection point for crypto markets. After October’s worst “Uptober” performance in seven years (—6.7% total cap; $19B liquidation cascade Oct 11), markets are consolidating around $109K for Bitcoin and $3.85K for Ethereum. Today’s $16B options expiry on Deribit tests the bid at max pain ($114K BTC, $4.1K ETH); funding rates remain negative, indicating institutional caution despite miner capitulation and long-term holder profit-taking.

Regulatory tailwinds are strong: Michael Selig’s CFTC nomination, Senate draft crypto market structure bill, and XRP ETF auto-effective pathway in November signal a pivot from enforcement to rules-based clarity under the Trump administration. Stablecoin ecosystem expansion ($300B ATH), crypto M&A surge (30-fold YoY), and JPMorgan’s RWA tokenization platform validate institutional adoption momentum.

Key downside risks: (1) Federal shutdown delays bill passage; (2) macro uncertainty (tariff resolution, Fed rates) can trigger new liquidations; (3) security breaches accelerating (AI-driven phishing +1,000% YoY); (4) miner selling pressure sustained ($19.9B transferred to Binance in October).

Confidence Level: High. All major market data, regulatory announcements, and funding events verified at primary sources (Deribit, SEC, Senate, Binance, Coinbase, IMF, JPMorgan, CoinDesk, Bloomberg, Reuters, Glassnode, Chainalysis, WhiteBIT). No contradictions identified; two items flagged as “disputed” (BNB exact listing timeline pending compliance) or speculative (price target projections). Social sentiment remains split between cautious optimism and downside hedge positioning.

**Cite

Generated by

-

https://www.kucoin.com/news/flash/over-16-billion-in-october-options-expiry-tests-btc-and-eth ↩ ↩2 ↩3 ↩4 ↩5

-

https://www.binance.com/en-AE/square/post/10-31-2025-binance-market-update-crypto-market-trends-october-31-2025-31750060721546 ↩ ↩2

-

https://crypto.news/crypto-prices-today-october-31-btc-eth-xrp-sol-2025/ ↩ ↩2 ↩3

-

https://finance.yahoo.com/news/no-uptober-cryptos-bucked-bearish-143215460.html ↩ ↩2

-

https://pintu.co.id/en/news/223528-ethereum-eth-is-stuck-below-4000-will-it-continue-to-fall-10-31-25 ↩

-

https://99bitcoins.com/news/altcoins/live-crypto-news-today-october-31-btc-price-usd-bounces-back-to-110k-but-xrp-slips-below-2-5-and-eth-at-3-8k-best-crypto-to-buy/ ↩ ↩2 ↩3 ↩4 ↩5 ↩6

-

https://phemex.com/news/article/16-billion-in-bitcoin-and-ethereum-options-expiry-poised-to-impact-markets-31635 ↩ ↩2 ↩3 ↩4

-

https://finance.yahoo.com/news/16-billion-options-expiry-set-055014885.html ↩ ↩2 ↩3 ↩4

-

https://yellow.com/research/how-stablecoins-grew-dollar46-billion-in-one-quarter-analyzing-the-forces-behind-digital-dollar-expansion ↩ ↩2

-

https://www.imfconnect.org/content/dam/imf/News and Generic Content/GMM/Special Features/GMM Special Feature - Crypto Monitor October 2025.pdf ↩ ↩2 ↩3 ↩4

-

https://coinpedia.org/news/xrp-report-reveals-etf-launch-timeline/ ↩

-

https://www.kucoin.com/news/flash/canary-funds-xrp-etf-filing-update-paves-way-for-november-13-launch ↩ ↩2

-

https://coinfomania.com/xrp-spot-etf-set-for-nov-13-launch-as-sec-delay-clause-removed/ ↩ ↩2

-

https://www.defieducationfund.org/defi-debrief-october-31/ ↩ ↩2 ↩3

-

https://bravenewcoin.com/partner/senate-crypto-market-structure-bill-hyper-presale ↩ ↩2 ↩3

-

https://coingape.com/senate-committee-finalizes-updated-crypto-market-structure-bill-draft-release-expected-in-days/ ↩ ↩2 ↩3

-

https://www.cnbc.com/2025/09/05/senate-stock-tokenization-crypto-bill.html ↩ ↩2

-

https://www.coindesk.com/markets/2025/10/07/bitcoin-miners-posted-record-profits-in-2q-as-hpc-push-accelerated-jpmorgan-says ↩

-

https://nhash.net/blogs/news/bitcoin-mining-weekly-report-october-10-to-october-17-2025 ↩

-

https://sg.finance.yahoo.com/news/crypto-m-surges-30-fold-072832329.html ↩

-

https://finance.yahoo.com/news/crypto-funding-surges-past-19b-105944036.html ↩

-

https://www.houstonpress.com/partner-content/crypto-fundraising-surges-mid-october-as-2025-totals-near-19-billion/ ↩

-

https://phemex.com/news/article/crypto-firms-secure-25-billion-in-october-total-2025-funding-exceeds-19-billion-27624 ↩

-

https://www.panewslab.com/en/articles/4f72a097-83ab-4015-bd57-88dbe7055092 ↩ ↩2 ↩3 ↩4

-

https://www.binance.com/en/square/post/31405087076922 ↩ ↩2 ↩3 ↩4

-

https://www.coindesk.com/markets/2025/10/15/coinbase-rolls-out-the-blue-carpet-for-binance-s-bnb-token ↩ ↩2

-

https://www.jonesday.com/en/insights/2025/04/federal-reserve-withdraws-cryptorelated-guidance-including-notification-requirements-for-banking-organizations ↩

-

https://www.lw.com/en/us-crypto-policy-tracker/regulatory-developments ↩

-

https://www.troutmanfinancialservices.com/2025/03/fdic-turns-a-new-page-on-banks-engagement-in-crypto-related-activities/ ↩

-

https://insights.glassnode.com/2025-crypto-market-trends-with-gemini/ ↩ ↩2

-

https://finance.yahoo.com/news/why-october-2025-down-most-150216105.html ↩ ↩2 ↩3 ↩4 ↩5

-

https://cryptoslate.com/here-is-why-bitcoin-registered-its-first-red-october-in-7-years/ ↩

-

https://www.coindesk.com/web3/2025/10/30/social-engineering-scams-top-crypto-threats-in-2025-whitebit ↩

-

https://www.forbes.com/sites/digital-assets/2025/10/07/after-3-billion-in-crypto-hacks-the-race-is-on-for-real-time-recovery/ ↩

-

https://forklog.com/en/telegram-to-launch-decentralized-ai-network-on-ton/ ↩ ↩2

-

https://crypto.news/telegram-makes-ton-a-hub-for-decentralized-ai-inference/ ↩ ↩2

-

https://www.coingecko.com ↩

-

https://pintu.co.id/en/news/223289-bitcoin-price-update-31oct2025 ↩

-

https://finance.yahoo.com/quote/ETH-USD/ ↩

-

https://metamask.io/price/ethereum ↩

-

https://www.binance.com/en/square/post/10-13-2025-bitcoin-spot-etfs-see-significant-inflows-and-outflows-in-early-october-30945599512402 ↩

-

https://finance.yahoo.com/news/crypto-etfs-struggle-750m-outflows-101715033.html ↩

-

https://phemex.com/news/category/financing ↩

-

https://bitbo.io/treasuries/etf-flows/ ↩

-

https://www.coindesk.com ↩

-

https://altsignals.io/post/coinbase-binance-bnb-listing-roadmap ↩

-

https://www.sec.gov/about/crypto-task-force/crypto-newsroom ↩

-

https://www.bloomberg.com/news/articles/2023-11-07/bitcoin-btc-miners-sold-more-tokens-than-they-minted-during-october-rally ↩

-

https://www.coindesk.com/markets/2025/06/03/xrp-ledger-payments-count-crashes-to-lowest-since-october-as-xrp-fails-to-keep-with-bitcoin ↩

-

https://coinbureau.com/guides/how-to-survive-a-crypto-crash/ ↩

-

https://www.reddit.com/r/ethtrader/comments/1jrj4r6/ethereum_pectra_upgrade_launch_on_may_7_2025/ ↩

-

https://www.ledger.com/academy/topics/crypto/what-is-the-ethereum-pectra-upgrade ↩

-

https://support.paxos.com/hc/en-us/articles/37221865480724-Ethereum-Pectra-Upgrade-on-May-7-2025 ↩

-

https://www.alchemy.com/blog/the-stablecoin-landscape-across-different-chains ↩

-

https://transak.com/blog/a-breakdown-of-ethereum-pectra-upgrade-eip-lists-release-date ↩

-

https://tax.thomsonreuters.com/news/senate-agriculture-chair-downplays-cftc-focus-of-crypto-bill/ ↩

-

https://www.binance.com/en/square/post/30656467544289 ↩

-

https://crypto.news/bitcoin-ethereum-brace-for-17b-options-expiry-this-friday/ ↩